Your credit score plays a crucial role in your financial well-being, influencing everything from loan approvals to interest rates. One of the most significant factors that impact your credit score is payment history, and late payments can have long-lasting effects on your financial health. In this DIY guide, we’ll explore how late payments affect your credit score and what steps you can take to recover and rebuild your financial standing.

How Late Payments Affect Your Credit Score

1. Payment History: The Largest Credit Score Factor

Your payment history makes up 35% of your FICO credit score, making it the most influential factor. When you miss a payment, credit bureaus record it, and lenders view it as a sign of financial risk.

2. Timeline of Late Payment Consequences

Lenders typically report late payments in different stages:

- 1-30 days late: Usually, lenders won’t report a late payment until it’s 30 days overdue. You may incur late fees, but your credit score may not be affected if you pay before this mark.

- 30-59 days late: At this stage, lenders report the missed payment to credit bureaus, causing a drop in your credit score.

- 60-89 days late: Your credit score drops further, and you may receive higher penalty fees and interest rates.

- 90+ days late: The account may be sent to collections, severely impacting your credit and making it difficult to get new credit.

3. Severity of Impact Based on Credit Score

- If you have a high credit score (700+), a single late payment can drop your score by 100+ points.

- If your score is already low, the impact may be less severe, but still significant.

- Multiple late payments can lead to loan denials, higher interest rates, and potential legal actions from lenders.

How to Recover from Late Payments

1. Pay the Past-Due Amount ASAP

The longer your payment is overdue, the more damage it does to your credit. If possible, pay the overdue amount immediately to prevent further negative marks.

2. Contact Your Lender

If you have a good history with your lender, ask for a “goodwill adjustment” or a late fee waiver. Some lenders may remove the late payment from your report if you have a strong repayment record.

3. Set Up Automatic Payments or Reminders

To avoid future late payments, consider:

- Setting up automatic payments to ensure you never miss a due date.

- Using calendar reminders or budgeting apps to track payment schedules.

4. Dispute Errors on Your Credit Report

If you believe the late payment was reported incorrectly, you can dispute it with the credit bureaus (Experian, Equifax, TransUnion) to have it removed.

5. Rebuild Your Credit Over Time

- Make all future payments on time to establish a positive payment history.

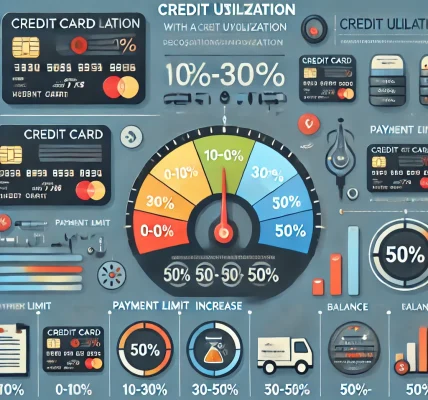

- Reduce your credit utilization ratio by paying down outstanding balances.

- Avoid opening too many new credit accounts at once.

How Long Do Late Payments Stay on Your Credit Report?

A late payment can stay on your credit report for up to 7 years, but its impact lessens over time, especially if you adopt better financial habits.

Final Thoughts: Take Control of Your Credit

Late payments can hurt your credit score, but recovery is possible with consistent financial responsibility. Paying bills on time, negotiating with lenders, and monitoring your credit report can help you regain financial stability and improve your credit score.