Medical bills play a crucial role in health insurance claims, influencing the approval, reimbursement, and overall claim settlement process. Understanding how medical bills affect health insurance claims can help policyholders navigate the complexities of healthcare expenses efficiently. This guide will explain the significance of medical bills, how they impact insurance claims, and provide tips to ensure a smooth claims process.

1. Understanding Medical Bills in Health Insurance Claims

1.1 What Are Medical Bills?

Medical bills are detailed invoices issued by healthcare providers that outline the services received, the cost of those services, and the amount payable by the patient and/or their insurance provider.

1.2 Why Are Medical Bills Important in Health Insurance Claims?

Medical bills serve as the primary documentation for:

- Verifying the medical services provided

- Determining coverage eligibility

- Calculating reimbursement amounts

- Preventing fraud and billing errors

2. Key Components of a Medical Bill

2.1 Patient Information

- Name, date of birth, and contact details

- Insurance policy number and provider details

2.2 Breakdown of Medical Services

- Doctor consultations, diagnostic tests, procedures, medications, and hospital stays

- Cost per service, along with any applicable insurance coverage

2.3 Total Charges and Amount Due

- Total cost of services

- Insurance-covered amount vs. patient’s out-of-pocket expense (deductibles, co-pays, co-insurance)

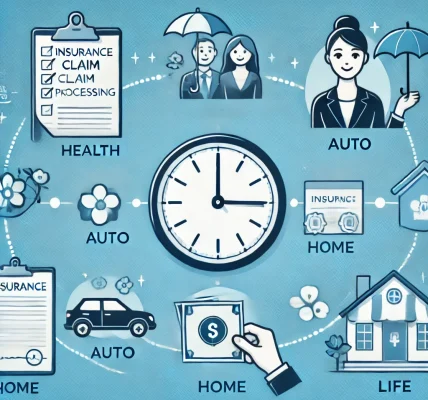

3. The Role of Medical Bills in the Health Insurance Claims Process

3.1 Step 1: Receiving Medical Treatment

Once a patient receives medical treatment, the healthcare provider generates a medical bill.

3.2 Step 2: Submitting the Claim

The patient or provider submits the medical bill to the insurance company, either manually or electronically.

3.3 Step 3: Claim Processing and Verification

The insurance company reviews the claim to:

- Verify treatment details

- Check policy coverage

- Identify deductible and co-payment amounts

3.4 Step 4: Approval or Denial of Claim

- If approved, the insurer reimburses the policyholder or directly pays the provider.

- If denied, the insurer provides reasons for rejection.

3.5 Step 5: Patient’s Financial Responsibility

- If there is any remaining balance, the patient must settle it directly with the provider.

4. Common Issues with Medical Bills in Health Insurance Claims

4.1 Errors in Medical Bills

- Incorrect patient details

- Duplicate charges or services not received

- Coding errors (wrong procedure codes)

4.2 Insurance Claim Denials Due to Billing Issues

- Services not covered under the policy

- Lack of prior authorization

- Expired or inactive insurance policy

4.3 Overbilling and Fraudulent Charges

- Upcoding (charging for a more expensive procedure than performed)

- Billing for unnecessary tests or treatments

5. How to Ensure a Smooth Health Insurance Claim Process

5.1 Review Medical Bills Carefully

- Check for errors or duplicate charges

- Verify treatment dates and procedure codes

5.2 Understand Your Insurance Policy

- Know what treatments and services are covered

- Be aware of deductibles, co-pays, and out-of-pocket maximums

5.3 Keep All Medical Documents Organized

- Save copies of medical bills, prescriptions, and insurance communications

- Maintain a record of payment receipts

5.4 Contact Your Insurance Provider When Needed

- Clarify claim submission procedures

- Request explanations for claim denials

- Seek assistance in case of disputes

6. How to Dispute Errors in Medical Bills or Insurance Claims

6.1 Identifying Errors

- Compare the medical bill with your insurer’s Explanation of Benefits (EOB)

- Contact the healthcare provider to clarify discrepancies

6.2 Filing a Claim Dispute

- Submit a formal request to the insurance company with supporting documents

- Escalate the matter to regulatory authorities if necessary

6.3 Seeking Legal Assistance (If Needed)

- If the issue remains unresolved, legal consultation may be an option

Final Thoughts

Medical bills are a fundamental part of health insurance claims, directly impacting the approval and reimbursement process. By understanding the role of medical bills, policyholders can minimize errors, avoid claim denials, and ensure a hassle-free claim settlement. Always review your bills, understand your policy terms, and communicate with your insurer to maximize your insurance benefits.