Life insurance is often overlooked or postponed, with many assuming it is unnecessary or too expensive. However, the true cost of not having life insurance can be far greater than the cost of premiums. The financial impact of an unexpected event can leave families struggling to pay bills, cover debts, and maintain their standard of living. This DIY guide will explore the risks of not having life insurance, the potential financial consequences, and steps you can take to secure your family’s future.

Understanding the Role of Life Insurance

Life insurance is a financial safety net that provides a lump sum payment (death benefit) to beneficiaries upon the policyholder’s passing. This amount can be used to cover expenses such as mortgage payments, daily living costs, children’s education, and outstanding debts. Without life insurance, loved ones may face financial instability and emotional distress during an already challenging time.

The Financial Risks of Not Having Life Insurance

1. Loss of Income for Dependents

If you are the primary income earner in your household, your sudden passing could leave your family without a stable financial foundation. This can lead to difficulties in meeting daily expenses, rent or mortgage payments, and even basic necessities such as food and utilities.

2. Unpaid Debts and Liabilities

Many individuals have loans, credit card balances, or other financial obligations. Without life insurance, your family may inherit these debts, creating a financial burden they may struggle to manage.

3. Costly Funeral and Burial Expenses

Funeral expenses can range from $7,000 to $15,000 or more, depending on location and services chosen. Without life insurance, these costs must be covered by family members, adding financial strain at a time of grief.

4. Children’s Education at Risk

Higher education expenses continue to rise, and without financial support, children may be forced to take on large student loans or forego higher education altogether.

5. Risk of Losing Assets

If your family cannot cover daily expenses, they may have to sell valuable assets such as property, vehicles, or investments. This can disrupt their financial stability and long-term financial security.

6. No Financial Support for Spouse or Aging Parents

Many individuals financially support not just their children but also their spouses or aging parents. Without life insurance, those who depend on you may struggle to maintain their lifestyle or afford necessary medical care.

7. Unexpected Medical Bills

Serious illnesses or accidents can result in significant medical expenses before death. If you lack life insurance, these unpaid bills may become a financial burden on your loved ones.

DIY Guide to Securing Your Family’s Future with Life Insurance

Taking proactive steps to secure a life insurance policy can ensure your family remains financially stable in your absence. Here’s how you can get started:

Step 1: Assess Your Financial Needs

Before selecting a policy, evaluate your financial situation by considering:

- Your current income and expenses.

- Outstanding debts such as mortgages, loans, and credit cards.

- Future financial goals, including children’s education and retirement planning.

Step 2: Choose the Right Type of Life Insurance

Life insurance comes in several types, each suited for different needs:

- Term Life Insurance – Provides coverage for a specific period (e.g., 10, 20, or 30 years) and is generally more affordable.

- Whole Life Insurance – Offers lifelong coverage with a cash value component that grows over time.

- Universal Life Insurance – Provides flexibility in premiums and death benefits, along with a savings element.

Step 3: Determine the Coverage Amount

A good rule of thumb is to choose a coverage amount that is 10 to 15 times your annual income. Use an online life insurance calculator to determine a more accurate coverage amount based on your specific needs.

Step 4: Compare Insurance Providers

Different insurers offer various policy options, premium rates, and benefits. Compare:

- Coverage options

- Premium costs

- Claim settlement ratios

- Customer reviews

Step 5: Understand Policy Terms and Conditions

Before purchasing a policy, carefully read the fine print to understand:

- Exclusions (what is not covered by the policy)

- Waiting periods

- Premium payment terms

- Claim settlement process

Step 6: Get a Medical Check-up (If Required)

Some policies require medical underwriting to assess health conditions and determine premium rates. Maintaining good health can help lower your premiums.

Step 7: Consult a Financial Advisor (Optional)

If you are unsure which policy to choose, consulting an insurance or financial advisor can provide personalized recommendations based on your financial situation.

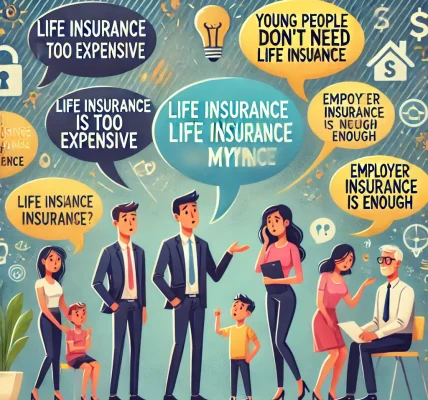

Common Myths About Life Insurance

1. “I Don’t Need Life Insurance Because I Am Young and Healthy”

Reality: The best time to buy life insurance is when you are young and healthy, as premiums are lower and coverage options are more favorable.

2. “Life Insurance is Too Expensive”

Reality: Term life insurance is affordable and can be tailored to fit your budget. Skipping unnecessary expenses for a few months can often cover an entire year’s worth of premiums.

3. “My Employer’s Life Insurance is Enough”

Reality: Employer-provided insurance is often limited and may not provide sufficient coverage. Additionally, coverage typically ends if you leave the company.

4. “Life Insurance is Only for Those with Dependents”

Reality: Even if you do not have dependents, life insurance can help cover funeral expenses, outstanding debts, or provide financial support for aging parents or partners.

How to File a Life Insurance Claim (For Your Family’s Future Reference)

- Notify the Insurance Company – Inform them of the policyholder’s passing as soon as possible.

- Gather Required Documents – This may include the death certificate, policy document, and identity proofs.

- Submit the Claim Form – Complete the necessary paperwork and provide all required documentation.

- Follow Up – Check with the insurance company regarding the status of the claim.

- Receive the Payout – Once the claim is processed and approved, the amount is disbursed to the beneficiaries.

Final Thoughts: Don’t Leave Your Family’s Future to Chance

The cost of not having life insurance is far greater than the price of monthly premiums. It can lead to financial hardship, emotional stress, and an uncertain future for your loved ones. By taking proactive steps to secure a life insurance policy, you can ensure that your family is protected from financial distress and unforeseen burdens.

Investing in life insurance is not just a financial decision—it is an act of love and responsibility. Secure your family’s future today by exploring the best life insurance options available to you.