Introduction

Retirement planning is a crucial aspect of financial security, yet many individuals make critical mistakes that can jeopardize their future. A well-planned retirement ensures financial stability, a comfortable lifestyle, and the ability to handle unexpected expenses. However, failing to prepare adequately can lead to financial stress in later years. In this blog, we will explore the most common retirement planning mistakes and provide guidance on how to avoid them to secure your future.

1. Delaying Retirement Savings

One of the biggest mistakes individuals make is postponing retirement savings. Many assume that they have plenty of time to start saving, but delaying contributions can significantly impact the final retirement corpus due to the power of compounding.

How to Avoid This Mistake:

- Start saving as early as possible, even with small contributions.

- Take advantage of employer-sponsored retirement plans like 401(k) or pension schemes.

- Increase contributions as income grows over time.

2. Not Having a Defined Retirement Plan

Many people fail to set clear retirement goals, leading to financial uncertainty. Without a proper plan, it is difficult to estimate how much money will be needed post-retirement.

How to Avoid This Mistake:

- Set realistic retirement goals, considering lifestyle, healthcare, travel, and inflation.

- Use retirement calculators to estimate future financial requirements.

- Seek advice from financial planners to develop a structured plan.

3. Underestimating Life Expectancy

People often assume a shorter life expectancy while planning, which can lead to insufficient savings. With increasing life expectancy due to medical advancements, individuals may outlive their savings.

How to Avoid This Mistake:

- Plan for a longer lifespan (85-90 years or more) when calculating retirement funds.

- Consider long-term care insurance to cover future medical expenses.

- Diversify investments to ensure continuous income post-retirement.

4. Relying Solely on Social Security or Pension Plans

Many retirees depend entirely on social security benefits or pensions, which may not be sufficient to maintain their desired lifestyle.

How to Avoid This Mistake:

- Build a diversified retirement portfolio, including savings, investments, and other income sources.

- Invest in stocks, bonds, mutual funds, or real estate to generate passive income.

- Regularly review and adjust retirement plans based on financial market trends.

5. Ignoring Inflation’s Impact

Inflation reduces the purchasing power of money over time. Failing to account for inflation can leave retirees with inadequate funds to cover expenses.

How to Avoid This Mistake:

- Factor in inflation while estimating future financial needs.

- Invest in inflation-protected securities and assets with growth potential.

- Adjust retirement withdrawals based on inflation rates.

6. Withdrawing Savings Too Early

Many individuals start withdrawing retirement funds early, resulting in unnecessary tax penalties and reducing the amount available during actual retirement years.

How to Avoid This Mistake:

- Follow the age-related withdrawal rules to avoid penalties.

- Establish an emergency fund separate from retirement savings.

- Create a withdrawal strategy that ensures funds last throughout retirement.

7. Not Diversifying Investments

Investing all savings in a single asset class, such as stocks or real estate, can be risky. Market fluctuations can significantly impact retirement funds if not properly diversified.

How to Avoid This Mistake:

- Spread investments across different asset classes (stocks, bonds, mutual funds, and real estate).

- Periodically rebalance the portfolio to align with financial goals and risk tolerance.

- Consult a financial advisor to optimize investment strategies.

8. Overlooking Healthcare and Long-Term Care Costs

Medical expenses can rise significantly with age, and not accounting for these costs can lead to financial strain.

How to Avoid This Mistake:

- Invest in health insurance or Medicare plans that cover medical expenses.

- Consider long-term care insurance for potential nursing home or assisted living costs.

- Build a separate healthcare savings fund to manage unforeseen medical expenses.

9. Not Updating Estate and Beneficiary Plans

Failing to update wills, trusts, and beneficiary designations can create complications for heirs and result in unnecessary legal battles.

How to Avoid This Mistake:

- Regularly review and update estate plans and beneficiary details.

- Consult an estate planning attorney to ensure legal compliance.

- Establish a power of attorney to handle financial matters in case of incapacity.

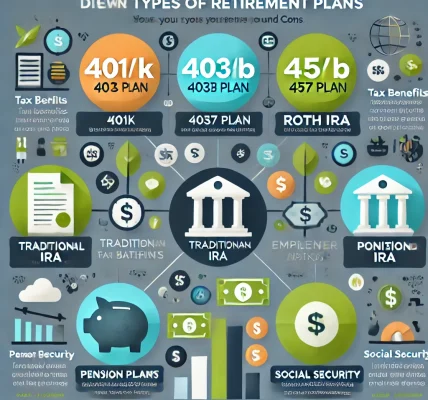

10. Ignoring Tax Implications

Many retirees fail to consider tax liabilities when withdrawing funds, leading to higher tax burdens and reduced savings.

How to Avoid This Mistake:

- Understand tax implications of different retirement accounts (401(k), IRA, Roth IRA, etc.).

- Strategically plan withdrawals to minimize tax liabilities.

- Work with a tax advisor to optimize tax-efficient retirement income strategies.

Conclusion

Retirement planning is a lifelong process that requires careful consideration and proactive financial management. By avoiding these common mistakes, individuals can ensure a comfortable and financially secure retirement. Starting early, setting realistic goals, diversifying investments, and accounting for healthcare and inflation are essential steps to safeguard one’s future. Consulting financial and legal experts can further enhance retirement security, helping individuals enjoy a stress-free post-retirement life.

By implementing these strategies, you can achieve financial independence and peace of mind during your golden years. Start planning today and secure the future you deserve!