Understanding credit inquiries is crucial for managing your credit health and increasing your chances of loan approval. Credit inquiries occur whenever a financial institution or lender checks your credit report. These inquiries fall into two categories: soft inquiries and hard inquiries. While soft inquiries don’t impact your credit score, hard inquiries can influence your ability to secure loans.

This guide explores the differences between soft and hard inquiries, how they affect your credit, and best practices to manage them responsibly.

1. Understanding Soft and Hard Credit Inquiries

What is a Soft Credit Inquiry?

A soft inquiry, also known as a soft pull, is a credit check that does not impact your credit score. Soft inquiries occur when:

- You check your own credit report.

- A potential employer runs a background check.

- A financial institution pre-approves you for a credit card or loan offer.

- A landlord checks your credit before renting an apartment.

Soft inquiries are used for informational purposes and do not indicate an active credit application. They are visible on your credit report but are not considered by lenders when making lending decisions.

What is a Hard Credit Inquiry?

A hard inquiry, also known as a hard pull, occurs when a lender or creditor checks your credit report to make a lending decision. Hard inquiries happen when:

- You apply for a credit card.

- You apply for a mortgage, auto loan, personal loan, or student loan.

- A lender reviews your credit for a credit limit increase request.

Unlike soft inquiries, hard inquiries can impact your credit score and are visible to other lenders. Multiple hard inquiries within a short period may signal financial distress and reduce your chances of loan approval.

2. How Do Credit Inquiries Affect Your Credit Score?

Impact of Soft Inquiries on Your Credit Score

Soft inquiries have no impact on your credit score. You can check your own credit report as often as needed without any negative consequences.

Impact of Hard Inquiries on Your Credit Score

Hard inquiries can temporarily lower your credit score. Here’s how:

- One hard inquiry may lower your score by 5-10 points.

- Multiple inquiries within a short time can have a larger impact.

- Credit inquiries remain on your credit report for up to 2 years, but their impact decreases after the first 6 months.

Are Multiple Hard Inquiries Always Bad?

Not necessarily. Some credit scoring models, like FICO, recognize rate shopping for major loans. If you apply for multiple mortgages, auto loans, or student loans within a short window (typically 14-45 days), they count as one inquiry rather than multiple separate ones.

3. How Do Credit Inquiries Affect Loan Approval?

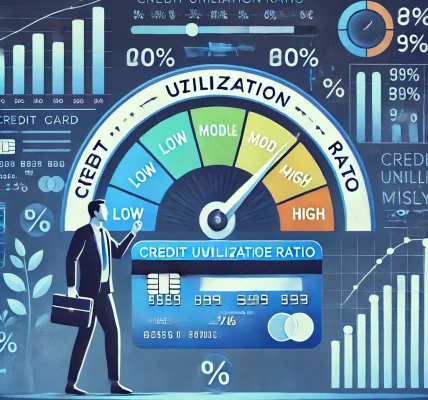

Lenders consider various factors when reviewing your credit application, including:

- Credit Score: Hard inquiries can slightly lower your credit score, making it harder to qualify for loans with competitive interest rates.

- Debt-to-Income Ratio (DTI): Lenders assess your ability to repay based on your income and existing debts.

- Number of Recent Hard Inquiries: Too many hard inquiries within a short period can make you appear financially risky.

- Overall Credit History: A strong credit history with on-time payments and low utilization can offset the impact of hard inquiries.

4. How to Manage Credit Inquiries Wisely?

Best Practices for Soft Inquiries

- Check your credit report regularly to monitor accuracy and detect fraudulent activity.

- Review pre-approved credit card or loan offers to understand potential credit options.

- Ensure employers and landlords perform soft inquiries when conducting background checks.

Best Practices for Hard Inquiries

- Apply for credit only when necessary to avoid unnecessary hard inquiries.

- Shop for loans within a short period to minimize the impact of multiple inquiries.

- Avoid multiple credit applications within a short timeframe to prevent lowering your credit score.

- Negotiate credit limit increases without a hard inquiry by asking your issuer if a soft pull is possible.

5. How to Remove Unauthorized or Incorrect Inquiries from Your Credit Report?

Sometimes, you may find unauthorized or incorrect hard inquiries on your credit report. Here’s how to dispute them:

- Get a copy of your credit report from Experian, Equifax, or TransUnion.

- Identify any inquiries you did not authorize.

- Contact the creditor associated with the inquiry and request removal.

- File a dispute with the credit bureau if the inquiry is fraudulent or incorrect.

- Monitor your credit report regularly to prevent future unauthorized inquiries.