Debt consolidation is the process of combining several debts, such as credit card balances, personal loans, and other unsecured loans, into a single loan. The idea is to make one payment instead of dealing with multiple debts, which can simplify your finances.

The new consolidated loan typically has a lower interest rate than the average rate of the debts being consolidated. This can help reduce the overall amount of interest you pay over time and may lower your monthly payments. The goal is to help you pay off your debt more efficiently and with less stress.

How Does Debt Consolidation Work?

Debt consolidation works by taking out a new loan to pay off existing debts. There are several ways to consolidate debt:

- Debt Consolidation Loan: A personal loan or line of credit that you use to pay off existing debts.

- Balance Transfer Credit Card: A credit card offering a 0% APR for an introductory period to transfer existing credit card balances.

- Home Equity Loan: If you own a home, you might use the equity in your property to secure a loan to consolidate your debts.

- Debt Management Plan (DMP): A program facilitated by a credit counseling agency, where you make a single monthly payment to the agency, which then pays your creditors.

Pros of Debt Consolidation

Debt consolidation can offer several advantages that make it an appealing option for individuals overwhelmed by debt. Here are the key benefits:

1. Simplified Payments

Managing multiple debts with varying due dates can be overwhelming. By consolidating your debts, you combine all payments into one. This can reduce the stress of remembering various payment deadlines and can help you stay organized.

2. Lower Interest Rates

Consolidating high-interest debts, such as credit card debt, into a loan with a lower interest rate can save you a significant amount of money over time. This is especially beneficial if your existing debt has high APRs (Annual Percentage Rates).

3. Lower Monthly Payments

In many cases, consolidating your debts can lower your monthly payment. This may be achieved by extending the repayment term, thus reducing the amount you need to pay each month. This can free up more of your income for other essential expenses.

4. Improved Credit Score

Consolidation can help improve your credit score by making it easier to manage and pay off your debt. When you successfully pay off existing balances and keep up with your consolidated loan payments, it demonstrates financial responsibility, which can positively affect your credit score.

5. Fixed Interest Rate

Many debt consolidation loans offer fixed interest rates, meaning your interest rate won’t fluctuate over time. This provides predictability in your monthly payments, unlike credit cards where interest rates can change.

6. Potential for Faster Debt Repayment

By lowering your interest rates and monthly payments, you can allocate more funds toward paying off the principal balance of your loan. As a result, you might be able to pay off your debt more quickly than if you continued making minimum payments on your individual loans.

Cons of Debt Consolidation

While debt consolidation offers many benefits, it is important to understand the potential drawbacks to ensure you make an informed decision.

1. May Extend Repayment Period

Consolidating your debt can result in a longer repayment term, which means you may be in debt for a more extended period. While this lowers monthly payments, it might increase the total interest you pay in the long run.

2. Secured Loans Carry Risk

If you use assets like your home to consolidate your debt (e.g., a home equity loan), you are putting those assets at risk. If you fail to make payments on the loan, you could lose your property. It’s important to evaluate your ability to repay before using secured loans.

3. Fees and Charges

Some debt consolidation methods, such as balance transfer credit cards or personal loans, can come with fees. These fees can negate some of the financial benefits of consolidating your debt. Always read the fine print and be aware of any hidden charges.

4. Not a Solution for Everyone

Debt consolidation is not a magic fix for financial problems. If you have accumulated debt due to poor spending habits, consolidation will only work if you commit to changing your behavior and not accumulating more debt.

5. Risk of Falling Deeper into Debt

If you consolidate your debt and then continue to use your credit cards or accumulate new debt, you risk falling deeper into financial trouble. Without a solid strategy for managing your finances, consolidation could be just a temporary fix.

How to Consolidate Debt the Right Way

If you decide that debt consolidation is the right choice for you, there are several steps you should take to ensure you do it correctly:

1. Assess Your Current Financial Situation

Before consolidating your debt, take a close look at your financial situation. Make a list of all your debts, including the interest rates and monthly payments. This will help you determine whether consolidation will save you money and if it is the right solution for you.

2. Consider All Your Options

There are various ways to consolidate debt, so it’s important to explore all your options. Compare interest rates, terms, and fees to find the best deal. Be sure to read the terms carefully and understand what you’re committing to.

3. Consult with a Credit Counselor

If you’re unsure about the best option for consolidating your debt, consider seeking advice from a certified credit counselor. They can help you understand your options and create a debt management plan that fits your needs.

4. Avoid Accumulating More Debt

Once you consolidate your debt, it’s essential to avoid accumulating more debt. Create a budget and stick to it. Limit your credit card usage and work towards living within your means.

5. Look for a Low-Interest Loan

When considering a debt consolidation loan, look for one with a lower interest rate than your current debts. This will ensure that you save money over time and make the process worthwhile.

6. Make Regular Payments

Once your debt is consolidated, it’s crucial to make consistent, on-time payments. Set up automatic payments or reminders to ensure you never miss a due date. Missing payments can harm your credit score and undo the benefits of consolidation.

Is Debt Consolidation Right for You?

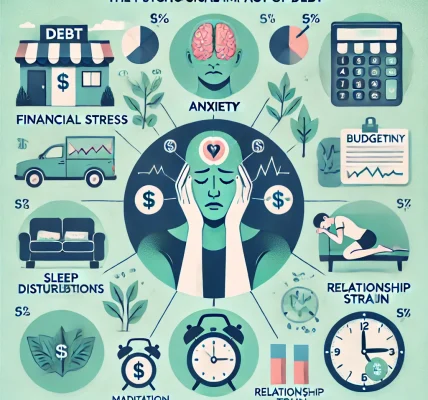

Debt consolidation can be an excellent solution if you have multiple high-interest debts and struggle with keeping track of your payments. However, it’s not the best solution for everyone. It’s important to consider your ability to repay the loan, your financial habits, and the fees associated with consolidation before deciding. Additionally, debt consolidation should be approached with discipline and a commitment to changing your financial habits to avoid falling back into debt.

Ultimately, debt consolidation can be a powerful tool to help you regain control of your finances. If done correctly, it can make debt repayment more manageable, reduce stress, and help you achieve financial freedom. But remember, it’s essential to be responsible with your finances to avoid falling into debt again.

Conclusion

Debt consolidation offers a structured way to manage multiple debts, but it’s not a one-size-fits-all solution. Carefully weigh the pros and cons and choose the consolidation method that best aligns with your financial goals. By consolidating your debt the right way and sticking to a disciplined repayment plan, you can move closer to achieving a debt-free future.