Having an insurance claim denied can be frustrating, especially when you are counting on financial assistance after an accident, property damage, or medical emergency. However, a denied claim doesn’t mean the end of the road. Understanding the reasons for denial and knowing the right steps to take can help you appeal the decision and get the compensation you deserve.

This DIY guide will walk you through why insurance claims get denied, how to dispute a denial, and what steps you can take to strengthen your case.

1. Understanding Why Insurance Claims Get Denied

Before taking any action, it’s essential to understand why your claim was denied. Insurance companies provide a denial letter outlining their reasons. Some common reasons include:

Common Reasons for Claim Denial:

- Lack of Coverage: The claim may fall outside the policy’s coverage.

- Policy Lapses: If your policy was inactive due to missed payments, your claim may be denied.

- Failure to Provide Proper Documentation: Missing documents or incomplete claims often lead to rejections.

- Pre-Existing Conditions or Exclusions: Some policies exclude specific conditions or damages.

- Discrepancies or Misrepresentation: Inaccurate information or inconsistencies in your claim can lead to denials.

- Missed Deadlines: Filing the claim too late might result in rejection.

- Failure to Follow Policy Terms: Not following proper procedures (e.g., not notifying authorities after an accident) can impact claim approval.

✔ Tip: Always review your policy documents carefully to understand coverage limits, exclusions, and claim filing procedures.

2. Reviewing the Denial Letter

Once you receive a denial letter, read it carefully to understand the insurer’s reasoning. It should provide:

- A clear explanation of why the claim was denied.

- Specific policy terms or exclusions that justify the denial.

- Any missing documentation or information required.

Steps to Take:

✔ Compare the denial reasons with your policy terms. ✔ Note any unclear language or vague justifications. ✔ Keep a copy of the letter for reference in case you need to escalate the dispute.

3. Gathering Additional Evidence

If you believe your claim was unfairly denied, start gathering supporting evidence to strengthen your case.

Helpful Documents to Collect:

- Policy Copy: Ensure you fully understand your coverage.

- Photos and Videos: Visual evidence of damages or injuries.

- Medical Reports: If applicable, get doctor’s reports and treatment records.

- Repair Estimates: For property or vehicle claims, get independent repair estimates.

- Witness Statements: If others were present during the incident, their testimony can be helpful.

- Police or Incident Reports: If required for your type of claim, submit an official report.

✔ Tip: Keep a record of all communication with your insurer, including emails, call logs, and claim submission dates.

4. Contacting Your Insurance Company

Before formally appealing, contact your insurer to discuss the denial. In some cases, misunderstandings or missing documents can be easily corrected.

How to Approach the Insurer:

✔ Stay calm and professional when discussing your claim. ✔ Ask for a detailed explanation of the denial. ✔ Request guidance on how to provide additional evidence or correct issues. ✔ Take notes and get everything in writing, including agent names and call summaries.

If the issue remains unresolved, move on to filing a formal appeal.

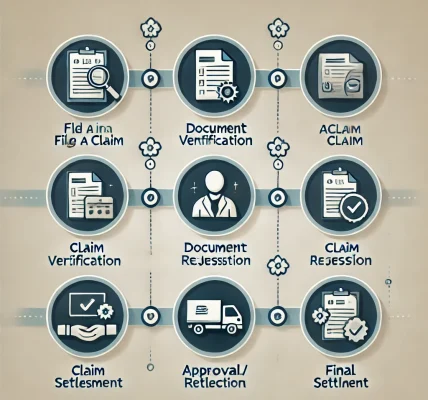

5. Filing a Formal Appeal

Most insurance companies allow policyholders to appeal a denied claim within a specific timeframe. Follow these steps to maximize your chances of success:

Steps to Appeal a Denied Claim:

- Write a Formal Appeal Letter: Clearly explain why you believe the denial was incorrect. Include claim details, policy references, and supporting evidence.

- Submit Additional Documentation: Attach missing or new evidence that supports your claim.

- Follow Up Regularly: Insurance companies process many claims, so be proactive in tracking your appeal status.

- Keep Copies of All Communications: Maintain a file with all correspondence related to your claim and appeal.

✔ Tip: Be concise but thorough in your appeal, ensuring all key points are covered.

6. Seeking Assistance from a Public Adjuster

If your appeal is denied or delayed, consider hiring a public adjuster to help you navigate the process. Public adjusters work for policyholders (not insurers) and can provide: ✔ A detailed claim review. ✔ Independent damage assessments. ✔ Negotiation support with the insurer.

7. Filing a Complaint with Regulatory Authorities

If you believe the insurance company is acting unfairly or violating regulations, you can escalate the matter by filing a complaint with the appropriate regulatory body.

Where to File a Complaint:

✔ State Insurance Department: Every U.S. state has an insurance regulatory authority. ✔ Ombudsman Services: Some countries have insurance ombudsman offices to handle disputes. ✔ Consumer Protection Agencies: Organizations like the Better Business Bureau (BBB) or Federal Trade Commission (FTC) may assist.

✔ Tip: Research your jurisdiction’s complaint process and provide all necessary documentation for faster resolution.

8. Taking Legal Action (As a Last Resort)

If all else fails, you may need to take legal action against the insurer. Consult an insurance attorney who specializes in claim disputes. They can: ✔ Assess whether your case has legal merit. ✔ Help file a lawsuit if the insurer is acting in bad faith. ✔ Negotiate a settlement before going to court.

When to Consider Legal Action:

- If the insurer refuses to reconsider a valid claim.

- If the denial violates state insurance laws.

- If the financial loss is significant and worth legal expenses.

✔ Tip: Many attorneys offer free consultations to evaluate your case before proceeding with a lawsuit.

Final Thoughts

A denied insurance claim can be discouraging, but you have options. By understanding why claims get denied, gathering strong evidence, and following the right steps to appeal, you improve your chances of getting a fair resolution. If necessary, seek professional help from public adjusters, regulators, or legal experts.